Monthly Reset Money Rituals – Reviewing Finances in a Way That Prevents Drift

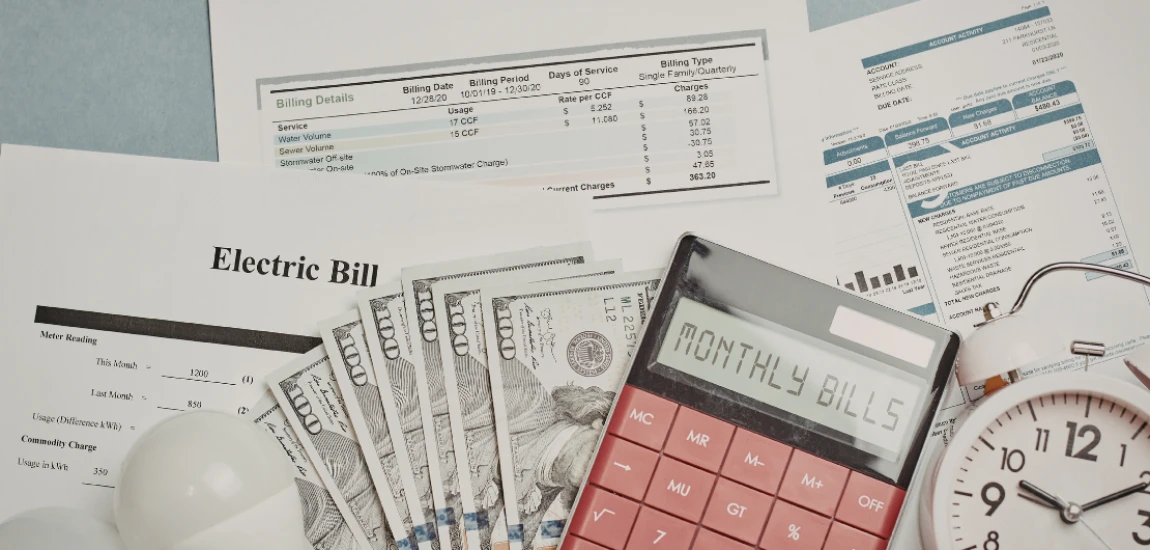

Financial drift is a common challenge: small oversights, missed bills, or unnoticed overspending gradually erode control over your money. Even with good intentions, without structured reflection, finances can slip into patterns of inefficiency, untracked spending, and unnecessary stress.

Monthly reset money rituals are intentional practices designed to prevent drift by creating consistent, reflective reviews of your finances. These rituals provide a structured approach to reviewing spending, reconciling accounts, assessing goals, and planning the month ahead. Over time, this consistent attention builds clarity, reduces stress, and strengthens financial discipline.

This blog explores practical steps for creating monthly reset money rituals, including actionable strategies, behavioral approaches, and tips for sustaining these practices effectively.

Understanding Financial Drift and Its Impacts

Financial drift occurs when small deviations in spending, saving, or goal-tracking accumulate unnoticed over time, reducing financial clarity and control.

How drift develops

Drift often begins with minor overspending or skipped account reviews. Without intervention, these small errors accumulate, making it harder to maintain budget discipline, stay on track with savings, or reach financial goals.

Psychological and emotional effects

The uncertainty caused by drift creates subtle stress. People may feel anxious checking balances, uncertain about available funds, or frustrated when goals are not being met. Over time, this can lead to reactive spending or avoidance of financial responsibilities.

Why monthly rituals prevent drift

Regular, structured review sessions create consistent feedback loops. These rituals help identify trends, correct deviations, and reinforce intentional financial behavior, preventing small issues from snowballing into significant problems.

Understanding drift highlights the need for deliberate monthly financial resets to maintain clarity, confidence, and control.

Structuring Your Monthly Reset Ritual

A monthly reset requires a structured process that covers all key areas of personal finance. Structure ensures consistency and prevents important elements from being overlooked.

Reconciling accounts

Start with reviewing bank, credit card, and investment accounts to ensure transactions are accurate. Detecting errors or unauthorized charges early prevents problems from escalating.

Reviewing spending patterns

Analyze monthly spending to compare actual expenses against budgeted amounts. Look for recurring overspending, patterns in discretionary purchases, and opportunities to optimize spending.

Assessing financial goals

Evaluate progress toward savings, debt repayment, or investment goals. Check whether actions align with long-term objectives and adjust allocations as necessary.

A structured monthly reset ensures a comprehensive view of finances, preventing drift and enabling proactive adjustments.

Categorizing and Tracking Expenses

Effective rituals rely on organized expense tracking, which helps identify deviations and guide future spending decisions.

Using budgeting categories

Group expenses into categories like essentials, discretionary spending, savings, and debt repayment. This allows you to pinpoint areas where spending may have exceeded expectations and identify opportunities to reallocate funds.

Monitoring recurring expenses

Track subscriptions, memberships, and automatic payments. Cancel or adjust services that are underused or no longer relevant to avoid unnecessary financial leakage.

Leveraging technology for tracking

Use personal finance apps, spreadsheets, or digital dashboards to consolidate spending data. Visual summaries and charts make deviations and trends easy to identify, reinforcing proactive management.

Categorizing and tracking expenses provides clarity and facilitates targeted adjustments during the monthly reset.

Evaluating Financial Goals and Adjusting Strategies

Monthly resets are an opportunity to assess whether actions are moving you toward your goals and to make strategic adjustments if needed.

Reviewing short-term objectives

Check whether immediate targets, such as emergency fund contributions or debt payments, are being met. Identify areas where adjustments or acceleration may be beneficial.

Aligning long-term goals

Evaluate progress toward bigger financial objectives like retirement, property acquisition, or investments. Small monthly adjustments compound over time, ensuring long-term alignment and growth.

Adjusting budgets and priorities

If expenses or income fluctuate, recalibrate budget allocations to maintain alignment with goals. This ensures that short-term deviations do not undermine long-term plans.

Evaluating goals ensures that monthly actions remain connected to overarching financial intentions.