Financial Surface Area Reduction – Fewer Accounts, Fewer Mental Interruptions

Modern personal finance has evolved into a fragmented landscape. Individuals often manage multiple checking accounts, credit cards, investment platforms, payment apps, and subscriptions. While each tool promises convenience or optimization, collectively they increase cognitive load, decision fatigue, and the likelihood of mistakes.

Financial Surface Area Reduction is about simplifying this landscape. The fewer accounts, logins, and touchpoints you have, the fewer mental interruptions your finances demand. Reducing financial surface area allows the mind to focus on strategy and priorities rather than juggling a multitude of minor transactions and updates.

This approach is less about limiting access to opportunities and more about intentionally consolidating, automating, and clarifying financial management. By designing a streamlined financial ecosystem, you create mental space, reduce stress, and improve long-term decision-making.

Understanding Financial Surface Area and Its Cognitive Impact

The Concept of Financial Surface Area

Financial surface area refers to the total number of accounts, subscriptions, and financial obligations an individual manages. High surface area creates multiple touchpoints that continuously demand attention, even when inactive. Each account requires monitoring, updating, or reconciling—fragmenting focus across platforms.

Cognitive Load from Fragmented Finances

Every account, app, or bill adds a small mental task: checking balances, verifying statements, remembering passwords, or categorizing transactions. These tasks, though minor individually, accumulate as mental friction, leading to distraction and fatigue.

Emotional Stress of High Surface Area

A cluttered financial landscape can increase anxiety. Forgotten subscriptions, overlooked bills, and mismatched accounts trigger stress, guilt, or panic. Reducing surface area provides a clear mental map of finances and a sense of control.

Benefits of Financial Surface Area Reduction

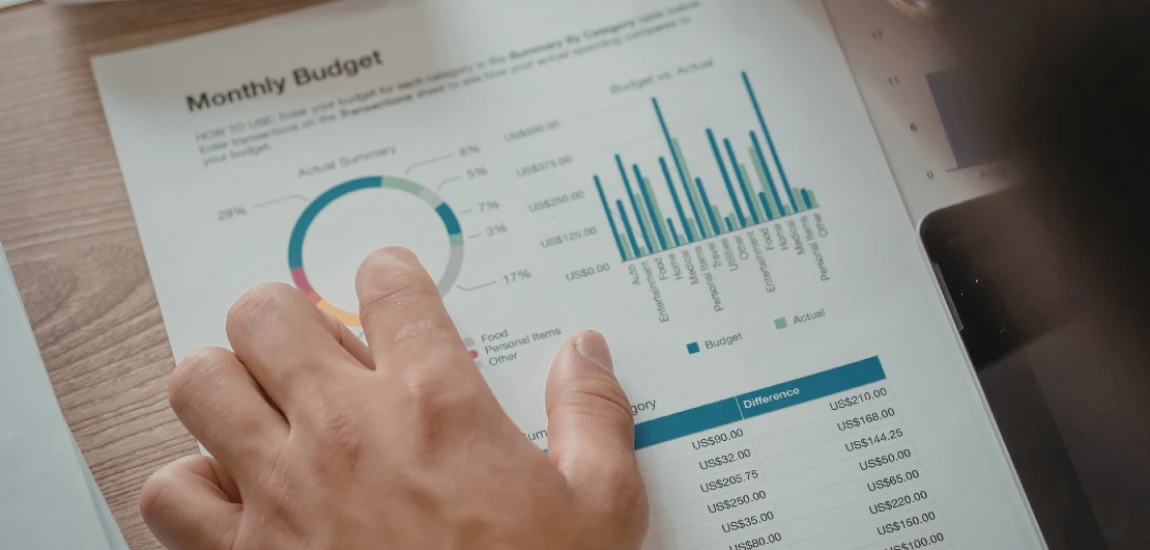

Simplified Tracking and Oversight

Fewer accounts mean fewer dashboards, logins, and statements to reconcile. This simplification reduces errors, makes budgeting easier, and allows for quick comprehension of your financial status.

Reduced Decision Fatigue

By consolidating accounts, you reduce the number of decisions triggered daily—from which account to pay bills from to which app to use for payments. This preserves mental energy for strategic choices rather than administrative minutiae.

Improved Long-Term Planning

With a streamlined setup, it’s easier to see where your money goes, optimize savings, and make investment decisions without being distracted by redundant accounts or minor transactions.

Strategies to Reduce Financial Surface Area

Consolidating Accounts

Where possible, merge checking, savings, and investment accounts. Banks often allow linking accounts for transfer and monitoring purposes, reducing login complexity and duplication.

Minimizing Payment and Credit Cards

Limit credit and debit cards to a few high-utility options. Fewer cards reduce the risk of fraud, simplify rewards tracking, and streamline monthly reconciliations.

Streamlining Subscriptions and Services

Audit recurring services and eliminate redundancies. Consolidate streaming, cloud storage, or financial software accounts. Automation tools can centralize management and reduce the need for manual checking.

Using Automation to Support Surface Area Reduction

Automatic Payments and Transfers

Scheduling bills and savings transfers reduces the need for constant attention. Automation ensures obligations are met on time, minimizing cognitive load and anxiety.

Alerts and Notifications for Essentials Only

Rather than monitoring every account constantly, configure notifications for significant changes—large transactions, low balances, or unusual activity. This preserves attention for critical events only.

Consolidated Reporting

Use tools that aggregate accounts into a single dashboard. Seeing balances and activity across multiple accounts in one interface reduces friction and reinforces trust in the simplified system.

Behavioral Adjustments to Maintain Reduced Surface Area

Regular Financial Audits

Periodic reviews prevent unnecessary accounts from creeping back into your system. Set aside time quarterly to reassess subscriptions, accounts, and apps.

Mindful Onboarding of New Financial Tools

Before opening new accounts, ask whether it genuinely reduces costs, increases utility, or simplifies your financial system. Avoid creating new surface area unless essential.

Creating Habits Around Consolidated Accounts

Develop consistent habits around your remaining accounts—such as logging in once daily, reviewing statements weekly, and reconciling monthly. Consistency reinforces clarity and reduces mental friction.