Algorithmic Budgeting: How AI-Powered Finance Tools Are Reshaping Personal Saving Habits

For decades, personal budgeting relied on spreadsheets, rigid rules, and self-discipline. Traditional methods assumed that people would consistently track spending, resist impulse purchases, and manually adjust plans as life changed. In reality, most budgets failed—not because people didn’t care about saving, but because human behavior is unpredictable.

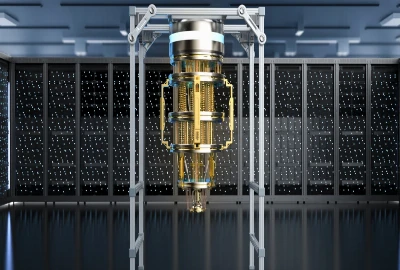

Algorithmic budgeting introduces a new approach. Instead of expecting users to manage money manually, AI-powered finance tools analyze spending patterns, predict future needs, and make real-time adjustments automatically. These systems don’t just track money—they interpret behavior.

From automated savings transfers to predictive cash-flow alerts, algorithmic budgeting is reshaping how individuals think about money, control expenses, and build long-term financial stability. This shift represents more than convenience—it marks a psychological and behavioral transformation in personal finance.

What Algorithmic Budgeting Really Means

Algorithmic budgeting refers to the use of artificial intelligence, machine learning, and data analytics to manage, optimize, and automate personal financial decisions.

Moving beyond static budgets

Traditional budgets are static snapshots. Algorithmic systems are dynamic, constantly updating based on income changes, spending behavior, and upcoming obligations.

Behavior-driven financial modeling

AI-powered budgeting tools learn from habits rather than intentions. They model real behavior, not idealized plans, making recommendations that feel realistic and achievable.

Continuous optimization of finances

Instead of monthly reviews, algorithmic budgeting adjusts daily. It reallocates savings, flags anomalies, and adapts to lifestyle changes automatically.

At its core, algorithmic budgeting shifts financial control from manual effort to intelligent systems. This reduces friction and removes emotional decision-making from routine money management.

How AI-Powered Finance Tools Influence Saving Behavior

Saving money is as much psychological as it is mathematical. Algorithmic budgeting tools are designed to influence behavior subtly and consistently.

Automation removes decision fatigue

Automated transfers and micro-savings eliminate the need for constant choices, making saving feel effortless rather than restrictive.

Predictive insights build confidence

AI forecasts future expenses and income gaps, helping users save proactively instead of reacting to financial stress.

Gamification and behavioral nudges

Many tools use progress tracking, visual goals, and positive reinforcement to encourage consistent saving habits.

By aligning with human psychology, algorithmic budgeting tools succeed where traditional budgeting often fails. They don’t rely on willpower—they design systems that work with human behavior instead of against it.

The Role of Data in Personalized Financial Planning

Data is the foundation of algorithmic budgeting.

Transaction-level intelligence

AI analyzes every transaction to understand patterns, identify wasteful spending, and uncover saving opportunities.

Contextual awareness

Location, timing, subscription cycles, and seasonal trends help systems anticipate financial needs accurately.

Hyper-personalized recommendations

Unlike generic budgeting advice, algorithmic tools tailor strategies to individual lifestyles, risk tolerance, and goals.

This level of personalization transforms financial planning from generalized advice into a customized experience that evolves continuously alongside the user.

Benefits and Risks of Algorithmic Budgeting

While algorithmic budgeting offers powerful advantages, it also introduces new concerns.

Improved consistency and accuracy

Automated systems reduce human error and maintain discipline even when motivation drops.

Over-reliance on automation

Blind trust in algorithms can reduce financial awareness if users disengage completely.

Data privacy and security concerns

Sensitive financial data requires strong protections to prevent misuse or breaches.

The value of algorithmic budgeting depends on balance. Used thoughtfully, it enhances control. Used passively, it may reduce financial literacy and agency.

How Algorithmic Budgeting Is Changing Financial Mindsets

Beyond tools and technology, algorithmic budgeting reshapes how people think about money.

From restriction to optimization

Budgets feel less like limits and more like systems designed to improve outcomes.

Long-term thinking becomes easier

AI highlights future implications of present behavior, encouraging delayed gratification.

Emotional detachment from money decisions

Automated decisions reduce guilt, anxiety, and impulsive reactions.

This mindset shift turns saving from a stressful obligation into a background process that supports broader life goals.